Introduction of Economic diversification

Economic diversification is a cornerstone of sustainable development strategies for nations worldwide. In an era marked by rapid globalization, technological advancement, and environmental challenges, the need to move beyond reliance on singular industries or sectors has become increasingly apparent. This introduction sets the stage for exploring the intricacies of economic diversification, from its definition and significance to its historical context and contemporary application.

Definition of Economic Diversification

At its core, economic diversification refers to the process of expanding a nation’s economy to encompass a wider array of industries and sectors. Rather than depending heavily on a single source of income, such as natural resources or a specific export, diversified economies spread their risk across multiple sectors. This enhances stability and fosters resilience in the face of economic shocks and global uncertainties.

Importance of Economic Diversification

The importance of economic diversification cannot be overstated, particularly in today’s interconnected world. Diversification mitigates the risks associated with over-reliance on a single industry and promotes long-term economic growth, innovation, and social development. By fostering a more balanced economic landscape, nations can better withstand fluctuations in global markets and adapt to changing circumstances.

Historical Context

Throughout history, numerous examples illustrate the perils of over-reliance on a single industry or sector. From the boom-and-bust cycles of gold rushes to the oil-dependent economies of the 20th century, nations have grappled with the consequences of monoculture economies. Understanding these historical contexts provides valuable insights into the need for economic diversification and the challenges involved in achieving it.

Examples of Economies Dependent on Single Industries

Examining real-world examples sheds light on the vulnerabilities inherent in economies reliant on single industries. Whether it’s oil-rich nations in the Middle East or agricultural economies in sub-Saharan Africa, the risks of over-dependence on a single sector are evident. Such economies are highly susceptible to fluctuations in commodity prices, environmental factors, and geopolitical tensions.

Consequences of Over-Reliance on a Single Sector

The consequences of over-reliance on a single sector can be far-reaching and profound. Not only do monoculture economies face heightened vulnerability to external shocks, but they also often struggle to diversify their economic base once their primary industry falters. This can lead to stagnation, social unrest, and diminished prospects for sustainable development.

The Benefits of Economic Diversification

In contrast, economic diversification offers many benefits to nations willing to embrace it. By spreading risk across multiple sectors, diversified economies enhance their resilience to economic shocks and mitigate the impact of downturns in specific industries. Moreover, diversification stimulates innovation, fosters the growth of new industries, and promotes environmental and social sustainability.

Enhanced Resilience to Economic Shocks

One of the primary benefits of economic diversification is enhanced resilience to economic shocks. By reducing dependence on a single industry, nations can better withstand downturns in global markets, fluctuations in commodity prices, and other external pressures. This resilience protects economies from sudden crises and enables more stable and sustainable growth over the long term.

Stimulating Growth and Innovation

Diversification also serves as a catalyst for growth and innovation. By investing in new industries and emerging sectors, nations can unlock untapped potential and create new opportunities for employment, wealth creation, and technological advancement. This, in turn, fosters a dynamic and competitive economic environment conducive to long-term prosperity.

Mitigating Environmental and Social Risks

Furthermore, economic diversification can help mitigate environmental and social risks associated with reliance on extractive industries or monoculture agriculture. By promoting the development of sustainable industries and embracing renewable energy sources, nations can reduce their ecological footprint and enhance environmental stewardship. Likewise, diversification can create more diverse and inclusive economies, reducing inequalities and promoting social cohesion.

Strategies for Economic Diversification

Achieving economic diversification requires a strategic and multifaceted approach. From policy frameworks to investment strategies, nations must employ various tools and interventions to foster a more diversified economic landscape. Key strategies include:

Policy Frameworks for Diversification

Governments play a crucial role in creating an enabling environment for diversification through targeted policies and regulations. This may include new industry investment incentives, support for small and medium-sized enterprises (SMEs), and measures to attract foreign investment.

Investing in Human Capital and Infrastructure

Investing in education, training, and skills development is essential for building a workforce capable of driving diversification and innovation. Likewise, investing in critical infrastructure, such as transportation networks, energy systems, and digital infrastructure, is crucial for supporting the growth of new industries and facilitating trade and investment.

Fostering Entrepreneurship and Small Business Development

Entrepreneurship and SMEs are often at the forefront of economic diversification, driving innovation, creating jobs, and fostering economic resilience. Governments can support entrepreneurship through access to finance, business development services, and regulatory reforms that reduce barriers to entry.

Encouraging Research and Development

Investing in research and development (R&D) fosters innovation and competitiveness in emerging industries. Governments can support R&D through funding initiatives, tax incentives, and partnerships between academia, industry, and government.

Leveraging Natural Resources Sustainably

For resource-rich countries, diversification often involves moving beyond extractive industries to develop value-added processing, manufacturing, and service industries. This requires sustainable management of natural resources and investment in downstream industries that create more value and employment opportunities.

Strengthening Trade and Investment Links

Trade and investment are essential drivers of economic diversification, allowing nations to tap into global markets and access new technologies and expertise. Governments can promote diversification through trade agreements, export promotion initiatives, and measures to attract foreign direct investment (FDI).

Case Studies

Examining successful case studies provides valuable insights into the strategies and challenges involved in economic diversification. Here are a few notable examples:

Norway: From Oil Dependency to Diversified Economy

Norway’s transition from an oil-dependent economy to a diversified and sustainable one is a testament to the power of strategic planning and investment. Through prudent management of oil revenues, investment in education and innovation, and support for emerging industries such as renewable energy and technology, Norway has successfully diversified its economic base while maintaining strong social welfare programs and environmental stewardship.

Singapore: The Success Story of Economic Diversification

Singapore’s remarkable economic transformation from a small trading port to a global financial and technology hub is a testament to its proactive approach to economic diversification. By investing in education, infrastructure, and strategic industries such as finance, biotech, and advanced manufacturing, Singapore has created a dynamic and resilient economy that thrives in the face of global challenges.

United Arab Emirates: Diversification Beyond Oil

The United Arab Emirates (UAE) has long been synonymous with oil wealth, but in recent years, the country has embarked on an ambitious diversification strategy to reduce its reliance on hydrocarbons. Through initiatives such as Vision 2021 and the UAE National Innovation Strategy, the country invests in sectors such as tourism, renewable energy, and knowledge-based industries to drive economic growth and create new opportunities for its citizens.

Rwanda: Transforming from Agrarian to Knowledge-based Economy

Rwanda’s journey from a war-torn agrarian economy to a burgeoning knowledge-based economy is a remarkable example of resilience and determination. Through targeted investments in education, technology, and entrepreneurship, Rwanda has leveraged its human capital and natural resources to foster innovation, attract foreign investment, and diversify its economy away from traditional sectors such as agriculture and mining.

Challenges and Obstacles

Despite the evident benefits, economic diversification is not without its challenges. Several key obstacles must be overcome to diversify economies successfully:

Political and Institutional Barriers

Political instability, corruption, and weak institutions can hinder diversification efforts by creating uncertainty and deterring investment. Strong political leadership and effective governance structures are essential for creating an enabling environment for diversification.

Short-Term vs. Long-Term Gains

Diversification often requires upfront investments and sacrifices in the short term for long-term gains. However, policymakers may face pressure to prioritize short-term economic gains over longer-term diversification objectives, leading to a lack of political will and strategic vision.

Resistance to Change

Economic diversification can disrupt established interests and traditional business ways, leading to resistance from vested interests and entrenched industries. Overcoming resistance to change requires stakeholder engagement, public awareness campaigns, and targeted incentives for innovation and entrepreneurship.

Financing Constraints

Diversification requires significant investment in new industries, infrastructure, and human capital, which can be challenging for resource-constrained governments and developing economies. Access to finance, both domestic and international, is crucial for funding diversification initiatives and overcoming financing constraints.

The Role of Technology in Economic Diversification

Technology plays a pivotal role in driving economic diversification in the modern era. From digital transformation to emerging technologies, innovation is reshaping industries and creating new opportunities for growth and development. Key aspects include:

Digital Transformation and Economic Diversification

Digital technologies are revolutionizing traditional industries and creating new opportunities for economic diversification. From e-commerce and digital finance to smart agriculture and telemedicine, digital transformation drives innovation and productivity across sectors.

Measuring Progress

Measuring progress in economic diversification is essential for evaluating the effectiveness of policies and interventions. Key performance indicators (KPIs) and monitoring tools enable policymakers to track diversification efforts, identify areas for improvement, and make informed decisions. Some important metrics include:

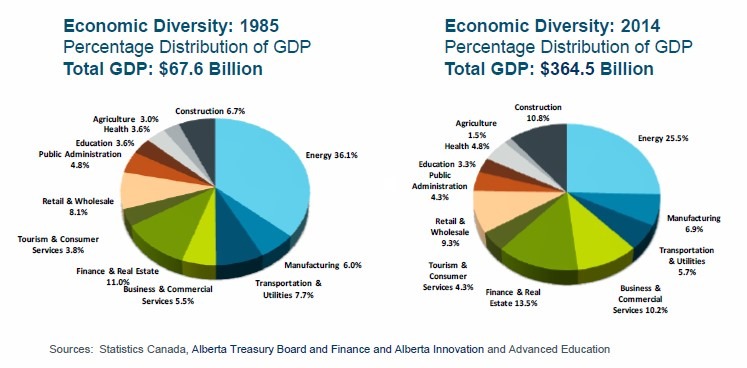

Key Performance Indicators for Economic Diversification

KPIs such as the share of GDP from non-resource sectors, employment diversification, and export concentration ratios can provide insights into the progress of economic diversification efforts.

Tools for Monitoring and Evaluation

Tools such as input-output analysis, value chain mapping, and sectoral diversification indices can help policymakers assess the impact of diversification policies and identify opportunities for further intervention.

FAQs (Frequently Asked Questions) on Economic Diversification

1. What is economic diversification?

Economic diversification refers to the process of expanding a nation’s economy to include a variety of industries and sectors, reducing dependence on a single source of income or export. It aims to spread risk and promote long-term growth and stability.

2. Why is economic diversification important?

Economic diversification is important because it enhances resilience to economic shocks, stimulates innovation and growth, and mitigates environmental and social risks. By fostering a more balanced economic landscape, nations can adapt better to changing circumstances and promote sustainable development.

3. How does economic diversification benefit countries?

Economic benefits countries by reducing vulnerability to external shocks, creating new opportunities for employment and wealth creation, and promoting social and environmental sustainability. It also fosters innovation, competitiveness, and long-term economic growth.

Conclusion

In conclusion, economic diversification is a theoretical concept and a practical imperative for nations seeking to build resilient, sustainable, and inclusive economies. By moving beyond reliance on single industries or sectors, nations can enhance their resilience to economic shocks, stimulate growth and innovation, and promote environmental and social sustainability. However, achieving economic diversification requires concerted efforts from policymakers, businesses, and communities, as well as long-term planning and strategic investment. It is essential for stakeholders at all levels to prioritize economic diversification efforts and work together to create a more prosperous and resilient future for all.